You can see how much an immediate annuity from a private insurer might pay in your situation by plugging the value of your lump sum into this annuity payment calculator.Ĭalculator: How much will I need for retirement? A 65-year-old woman would get roughly $1,820 a month, and a 65-year-old couple (man and woman) would receive about $1,600 a month that would be paid as long as either of them is alive. Today, for example, a 65-year-old man who uses a lump sum of, say, $350,000, to buy an immediate annuity from an insurance company would receive about $1,920 a month for the rest of his life.

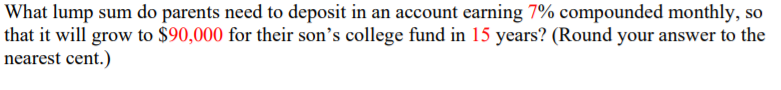

#90000 lump sum 7 years from now plus

To estimate the chances that your lump sum plus any other savings would be able to support you throughout retirement given the amount you expect you would have to withdraw each year to pay expenses not covered by Social Security, you can go to a retirement income calculator that uses Monte Carlo simulations to make its projections.īut if Social Security falls well short of covering essential expenses - or if you think you would just feel more secure with having more guaranteed income than you'll get from Social Security alone - then taking the monthly payments as a lump sum may be the better way to go.īefore you do that, however, it's a good idea to see how the monthly pension payments your company is offering stack up against the payout you could get by taking the lump sum, rolling it into an IRA (so the entire lump isn't immediately taxed) and then using that money to purchase an immediate annuity held within the IRA. Instead, you may be able to take the lump sum, invest it and cover necessities and all or most discretionary expenses by taking draws from that lump amount plus any other retirement savings you may have. If Social Security alone is enough to cover all or nearly all of your basic expenses, then you may not need additional assured income from a pension. If you're not already receiving Social Security payments, you can find out how much you're likely to qualify for at different ages by going to Social Security's Retirement Estimator. Next, consider the income you'll have to cover your expenses, starting with Social Security. Related: 273,000 union workers and retirees brace for pension cuts This will give you a much better sense of how much wiggle room you have to pare back expenses should you need to in the future. You want to create an actual retirement budget, which you can do by revving up an online tool like BlackRock's Retirement Expense Worksheet or the budget worksheet within Fidelity's Retirement Income Planner tool.Īs you're going over your expenditures, try to separate essential expenses, such as housing costs, taxes, food and health care, from discretionary ones such as travel, entertainment and eating out. Don't rely on rules of thumb like the one that says you can generally cover your retirement outlays with 70% to 80% of your pre-retirement income. The place to begin is by getting a handle on the expenses you'll face in retirement. So how can you sift through these pros and cons to come up with an arrangement that works best for your particular situation?

While doable, investing your nest egg and managing withdrawals so that it can sustain you over a retirement that may last 30 or more years can also be a daunting task that you shouldn't take lightly, especially given today's miserly yields and the low rates of investment returns that many investment pros believe we'll see in the future.

But you've got to be able to invest that money in a way that ensures you won't outlive it and end up spending the latter part of retirement scraping by and wishing you'd opted for lifetime payments.

Taking the lump sum, on the other hand, gives you a lot more flexibility in spending and meeting unexpected outlays (or indulging in the occasional splurge). But if you have few retirement resources beyond that pension income, life could get difficult if you need to come up with a sizable wad of cash for an emergency or large unanticipated expense.

Knowing you'll receive a check each month for the rest of your life even if stocks are being mauled by a severe bear market can engender a sense of well-being and financial security that research shows can lead to a more satisfying and happier retirement. Each option has advantages and disadvantages.

0 kommentar(er)

0 kommentar(er)